Introduction & Background

The Global Platform for Sustainable Natural Rubber (GPSNR) is an international multi-stakeholder, voluntary membership initiative seeking to lead improvements in the socioeconomic and environmental performance of the natural rubber value chain. Development of GPSNR was initiated by the CEOs of the World Business Council for Sustainable Development (WBCSD) Tire Industry Project (TIP) in 2019. Members of the platform include tire manufacturers, rubber suppliers and processors, vehicle makers and NGOs. Representatives from each of these stakeholder groups have contributed to the development of the Singapore-based platform and the wide-reaching set of priorities that define GPSNR strategy and objectives.

In 2021, GPSNR’s Capacity Building Working Group has identified that a digital knowledge sharing platform (KSP) is crucial to GPSNR’s future operations. The GPSNR Secretariat and the GPSNR Capacity Building Working Group, through the GPSNR Knowledge Sharing Platform Task Force, are jointly overseeing the development and eventual operations and maintenance of a digital GPSNR Knowledge Sharing Platform called Rubber Wiki.

Rubber Wiki will serve as a centralized digital hub, enabling smallholder rubber producers worldwide to access to technical information on relevant global news, latest sustainability best practices and Good Agricultural Practices, daily natural rubber prices, weather forecast and recommended activities, communication features and others. It will also facilitate peer-to-peer exchange of best practices, working conditions, and experiences, fostering coordination and collaboration within the global natural rubber production community.

GPSNR successfully completed the initial phase of the project, which involved conducting a comprehensive assessment of existing digital tools and evaluating the digital capabilities and needs of smallholder rubber producers. Currently, GPSNR is in the midst of the second phase, focusing on the development of multi-lingual mobile application features for the KSP. The second phase is expected to be completed in mid-December 2023.

To fully realize the Rubber Wiki’s potential, GPSNR is now seeking proposals to strengthen the critical third phase, which centers on content development for Rubber Wiki.

This is a crucial phase as it will enable the KSP to achieve its core objectives by facilitating effective knowledge exchange and collaboration among smallholder rubber producers worldwide. Through the development of high-quality and tailored content, GPSNR aims to address the specific challenges and requirements faced by smallholders.

To ensure the content’s relevance and effectiveness, interested bidders should undertake comprehensive adaptations for the contents that take into consideration of both the global nature of the industry and the unique contexts of smallholder rubber producers in different regions.

Objectives

1. Inventory & Develop Materials/Modules

Conduct a comprehensive inventory of content related to GAP, disease fighting, agroforestry, tapping qualities, etc., addressing smallholders’ challenges. Ensure that this content aligns with GPSNR’s values and guidelines. Incorporate resources from members/partners and develop new content if there’s no suitable materials available (subject to discussion and approval by the KSP Task Force) to cater to specific and diverse needs of smallholders.

2. Consistency & Adaptability

To ensure all materials/modules are consistent and adaptable across regions. Bridge regional requirements through research and suitable content, style, and languages for effective knowledge sharing.

3. Ownership & Compliance

Secure rightful ownership of acquired/developed content, duly registered with GPSNR. Address copyright/licensing concerns for content protection.

4. Integration & User-Friendly

Evaluate materials/modules for seamless integration into the KSP platform. Implement adaptations (formatting, language localization, and technical optimization) for easy access and navigation.

5. Functional Implementation

Ensure operational efficiency and functionality of the KSP platform, encouraging active user engagement in knowledge sharing.

Activities Required

The proposed studies/activities required for Phase 3 – Content Development for the KSP are as follows:

1. Identify, Adapt and Develop Materials/Modules

– Conduct a comprehensive inventory of existing materials/modules related to Good Agricultural Practices (GAP), disease fighting, agroforestry, tapping qualities, and other relevant topics specifically tailored for smallholder natural rubber producers. The determination of relevant topics will involve discussions with the KSP Task Force to ensure alignment with the specific needs and challenges faced by smallholders in the natural rubber production sector.

– Identify and collaborate with members or partner organizations to access relevant content resources and incorporate them into the KSP.

– Conduct research and develop new content materials/modules to fill identified gaps and cater to the specific challenges faced by smallholders in different regions.

– Evaluate the identified content materials/modules for consistency across different regions to ensure alignment with local regulations, best practices, and specific challenges faced by smallholder rubber producers in each respective region.

– Implement strategies to ensure that content is consistent and adaptable to the local context.

– Determine and incorporate the necessary adaptations, such as adapting the materials’ content to comply with local requirements, formatting, language localization, and more.

2. Testing & Adjustment / Quality Control

Conducting acceptance testing and review of the modules/materials to ensure accuracy, reliability, and adherence to industry best practices. This includes verifying information, checking for inconsistencies or errors and engaging subject matter experts for peer review. Necessary adjustments should be made based on feedback and evaluation to ensure high-quality and user-friendly content.

3. Ownership Rights and Copyright Compliance

– Ensure all content materials/modules acquired or developed are rightfully obtained, and their ownership is registered with GPSNR.

– Address any copyright or licensing concerns to secure the intellectual property rights of the content.

4. Integration and Implementation

– Evaluate and adapt the identified content materials for seamless integration into the KSP platform.

– Implement, test, and make necessary adaptations, such as formatting, language localization, and technical optimization, to ensure easy user access to the developed contents.

5. Monitoring, Evaluation, and Continuous Improvement

Monitor platform usage, evaluate its effectiveness, and continuously update and enhance the platform based on feedback and evaluation.

6. Progress reporting

Provide a brief summary of the activities undertaken during the reporting period.

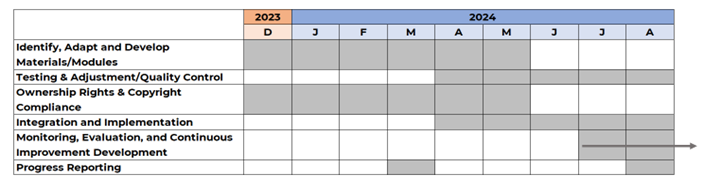

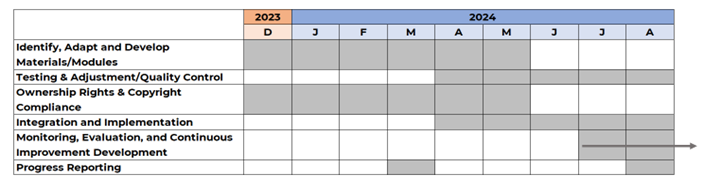

The proposed durations for each activities stated above are:

Expected Deliverables

- Identify, Adapt and Develop Materials/Modules

a. Development of a minimum of 50 materials/modules covering:

i. Proposed topics of Materials/Modules:

1) Good Agricultural Practices (GAP)

2) Disease Fighting

3) Agroforestry

4) Tapping Qualities

5) Improving yields through approved rubber clones

6) Others relevant topics addressing specific challenges faced by smallholders (subject to discussion and approval by the KSP Task Force)

ii. Regional Coverage: Indonesia, Thailand, Côte d’Ivoire, Malaysia, Cambodia, Vietnam, Sri Lanka, Myanmar, Liberia, India, Brazil, Ghana

iii. Languages: Bahasa Indonesia, English, Thai, French, Khmer, Bahasa Malaysia, Vietnam, Sinhalese, Burmese, Spanish, Portuguese, Tamil

iv. Format: text-based materials, audio-visual contents (such as movies, videos, animations, cartoons, infographics) and other suitable formats.

-

- Creation of a guidance document for users and a content inventory system for content managers, providing detailed information on modules/materials and relevant content resources.

- Testing & Adjustment / Quality Control

- Submission of a quality control report on the developed modules/materials, inclusive of language localization and formatting testing to ensure adaptability for different regions.

- Implement feedback mechanisms allowing users to provide input on the content’s usefulness and effectiveness.

- Ownership Rights and Copyright Compliance

● Provide copyright/licensing documents demonstrating the rightful acquisition or development of materials/modules and registration of intellectual property rights with GPSNR.

- Integration and Implementation

● Demonstration of the complete integration and implementation of developed modules/materials into the KSP, ensuring accessibility and usability within the platform.

- Monitoring, Evaluation, and Continuous Improvement

● Collection and submit report on of data on user interactions, time spent on modules, user feedback, and other relevant usage statistics, along with lessons learned or findings.

- Progress Reporting

● Submission of a mid-term report containing project summary, key milestones, module/materials development summary, quality control details, intellectual property rights information, challenges and recommendations.

● The final report and presentation will document the project’s process and outcomes, providing a roadmap for future Knowledge Sharing Platform enhancements.

Submission Guidelines & Requirements

The following submission guidelines & requirements apply to this Request for Proposal:

- Proposals will only be accepted from individuals or firms with experience relevant to this project. Examples of previous relevant work should be provided, as well as resumes of all key personnel performing the work. We welcome joint-organizations to submit proposals for this RFP.

- A detailed technical proposal must be provided. The technical proposal should include, but is not limited to, the following:

● A workplan that outlines proposed methodology to carry out all key activities stated above. Interested bidders are welcome to propose additional activities that are deemed important in ensuring successful executive of this project.

● Key outputs align with the expected deliverables stated above.

● Timeline and key operational stages.

● Price proposal (budget), detailing an overall fixed price and a breakdown of expected costs for manpower, logistics, and other project-related expenses.

● Description of past work and technical expertise that is relevant to this RFP.

● A list of project team members with their roles in the project and associated qualifications.

- Proposals must be signed by a representative that is authorised to commit the bidder’s company.

- Proposals must be received prior to the 24th November 2023 to be considered. Proposals should be submitted to cheewei@gpsnr.org for consideration.

- GPSNR reserves the right to amend the scope and budget of this RFP in order to get the most suitable consultant for each topic.

Project Timelines

|

RFP publication

|

8 November 2023

|

|

Submission deadline for proposals

|

24 November 2023

|

|

Evaluation of proposals and follow up

|

24 November – 7 December 2023

|

|

Contract Award and Notification to Unsuccessful Bidders

|

8 December 2023

|

|

Proposed Project commencement date

|

15 December 2023

|

|

Mid-term review

|

March 2024

|

|

Final review

|

August 2024

|

The above timeline is open to further adjustments based on discussions with the interested bidder(s) and GPSNR’s ongoing key milestones.

Budget

The Platform is anticipating that a total budget of no more than 80,000 EUR be allocated to this RFP.

The proposed payment terms are as follows:

● 20% at the signing of the contract

● 30% at the Mid-term Review (the date will be agreed upon and documented in the contract)

● 50% on Final Review

These payment terms are subject to further adjustments based on discussions with the interested bidder(s) and the project timeline.

Evaluation Factors

GPSNR will rate proposals based on the following factors, with cost being the most important factor:

1. Responsiveness to the requirements set forth in this Request for Proposal

2. Relevant past performance/ experience

3. Samples of work

4. Proposed price/budget

5. Technical expertise/experience of bidder and bidder’s staff

6. Proposed timeline

When evaluating bids, GPSNR may request for more information as part of a full due diligence to understand bidders’ technical and commercial background, assess potential conflicts of interests and independence vis-à-vis natural rubber smallholders and the wider agricultural sector, and level of competence for the project.

GPSNR reserves the right to award to the bidder that presents the best value to GPSNR as determined solely by GPSNR in its absolute discretion.

View RFP Document here